Asia Pacific Drug Development Market Size and Research

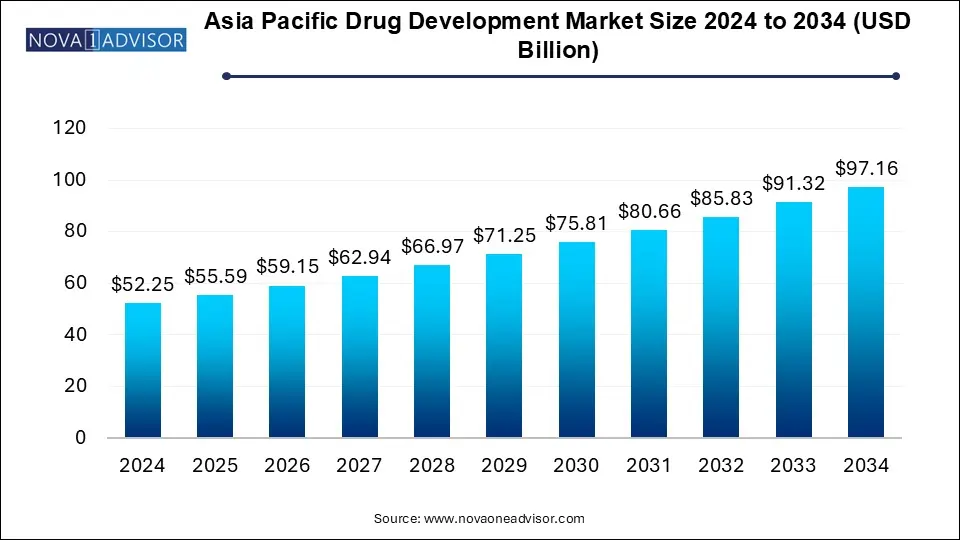

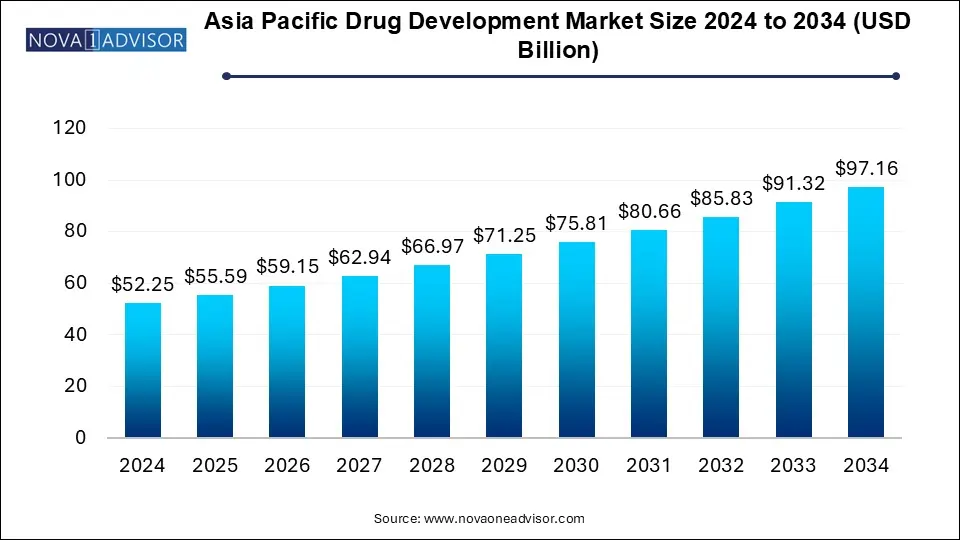

The Asia Pacific drug development market size was exhibited at USD 52.25 billion in 2024 and is projected to hit around USD 97.16 billion by 2034, growing at a CAGR of 6.4% during the forecast period 2025 to 2034.

Asia Pacific Drug Development Market Key Takeaways:

- In house drug development dominated the market and accounted for a share of 52.8% in 2024.

- Outsourced drug development is expected to register the fastest CAGR of 7.4% during the forecast period.

- Process research development accounted for the largest market revenue share of 19.6% in 2024.

- The DMPK (Drug Metabolism and Pharmacokinetics) segment is expected to register the fastest CAGR of 7.7% during the forecast period.

- Oncology dominated the market and accounted for a share of 38.0% in 2024.

- Inflammation & immunology are projected to grow at the fastest CAGR of 7.5% over the forecast period.

- China dominated the Asia Pacific drug development market with as share of 32.5% in 2024.

Market Overview

The Asia Pacific Drug Development Market is emerging as a pivotal hub for global pharmaceutical innovation, manufacturing, and regulatory evolution. With a confluence of factors including favorable government policies, a growing patient population, skilled scientific talent, and cost-efficient operations, the region is attracting substantial investment from global biopharma companies. Drug development refers to the comprehensive process that encompasses discovery, preclinical studies, clinical trials, regulatory approval, and commercialization of new therapeutic molecules.

Over the last decade, the region has witnessed a dramatic transformation in its drug development landscape. Countries such as China, India, and Japan are not only involved in clinical trials but also significantly contributing to early-phase discovery and regulatory science. Meanwhile, emerging players like South Korea, Thailand, and Australia are building globally compliant R&D ecosystems. Governmental reforms have played a key role—China's National Medical Products Administration (NMPA) has aligned its review timelines with global standards, and India has simplified its clinical trial approval process to attract sponsors.

The region’s growing middle-class population, coupled with an increasing burden of chronic diseases such as cancer, cardiovascular disorders, and autoimmune conditions, continues to drive demand for novel therapies. Additionally, Asia Pacific’s increasing involvement in biosimilars, biologics, and cell & gene therapies underscores its transition from a manufacturing back-office to a strategic R&D partner in the global pharmaceutical chain.

Major Trends in the Market

-

Rapid Growth in Clinical Trials: Countries such as China, India, and South Korea are seeing a surge in Phase I–III trials due to large treatment-naïve populations and cost advantages.

-

Biologics and Biosimilars Innovation: Japan and South Korea are investing in biologics manufacturing and clinical research, with several local firms developing pipeline monoclonal antibodies and biosimilars.

-

Rise in Outsourcing Models: Pharma companies increasingly prefer Contract Research Organizations (CROs) and CDMOs across Asia for early development, DMPK, formulation, and regulatory services.

-

Digitization of Drug Development: Technologies such as AI, big data, and electronic data capture systems are being used for patient recruitment, biomarker identification, and protocol optimization.

-

Regulatory Harmonization: Asian countries are aligning drug review frameworks with ICH-GCP and FDA/EMA standards to improve global market accessibility.

-

Increased Focus on Personalized Medicine: Genomic studies and stratified trial designs are becoming common, especially in oncology trials in China and Japan.

-

Collaborative Academic-Industry Platforms: Governments and universities are launching translational research hubs that combine discovery science with commercial application.

Report Scope of Asia Pacific Drug Development Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 55.59 Billion |

| Market Size by 2034 |

USD 97.16 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 6.4% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Mode, Process Step, Therapeutic Area, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

Asia Pacific |

| Key Companies Profiled |

Samsung Biologics; WuXi Biologics; CELLTRION INC; PT Kalbe Farma Tbk.; Eurofins Advinus; Laboratory Corporation of America; Celerion; Parexel International (MA) Corporation |

Key Market Driver: Cost-Efficiency and Speed of Development in Asia

The dominant driver of drug development activity in Asia Pacific is the region’s unparalleled cost-efficiency and operational speed. Compared to North America and Western Europe, drug development services in Asia ranging from formulation to early-phase clinical trials can be conducted at significantly reduced costs, often 30–60% lower. This pricing advantage does not come at the cost of quality; regulatory frameworks, infrastructure, and workforce competencies have markedly improved across the region.

China’s innovative drug approval reforms, India’s extensive generics and biosimilars expertise, and South Korea’s digital integration into trial processes are enabling faster study start-up, enrollment, and data reporting. For example, India’s Central Drugs Standard Control Organization (CDSCO) has established single-window approval systems that have slashed timelines for Phase I and II trials. Meanwhile, companies like WuXi AppTec (China) and Syngene (India) are offering comprehensive, end-to-end development services, further enhancing time-to-market efficiencies. These dynamics have made Asia Pacific not just a cost center, but a value center in the global drug development value chain.

Key Market Restraint: Regulatory Fragmentation and Variability

Despite advances, one of the key restraints in the Asia Pacific drug development market remains the fragmented regulatory landscape. While individual countries are making progress toward harmonizing with international standards, substantial variability persists in trial approval processes, documentation requirements, and data acceptance criteria. For multinational sponsors, navigating the unique legal, ethical, and operational protocols of each country can pose logistical hurdles and increase compliance risks.

For instance, while Japan and South Korea have mature and predictable regulatory systems, approval timelines in countries like Indonesia or Thailand can be protracted due to bureaucratic bottlenecks or evolving rules. Furthermore, language barriers, lack of centralized regulatory portals, and inconsistencies in Good Clinical Practice (GCP) enforcement hinder cross-border collaboration. These issues can delay clinical trial initiation and complicate multi-country Phase III trials in the region. Unless regional regulatory convergence possibly via mechanisms like ASEAN CTPWG or APAC harmonization platforms accelerates, this fragmentation will continue to restrict seamless operations and investments.

Key Market Opportunity: Expansion of Early-Stage R&D and Biotech Innovation

The Asia Pacific region holds immense opportunity in the expansion of early-stage research and biotech innovation, especially in areas like precision oncology, rare diseases, and immunology. Historically known for generics and bioequivalents, the region is now investing in first-in-class and best-in-class molecules. This is facilitated by growing biotech clusters, academic spin-offs, and government-backed research initiatives.

For instance, Japan’s AMED (Japan Agency for Medical Research and Development) and South Korea’s Bio-Vision 2025 initiative offer funding and infrastructure support for novel therapeutics. Chinese biotech companies, including BeiGene and Innovent, are leading global partnerships for novel antibody drugs. India’s Department of Biotechnology (DBT) is also nurturing indigenous R&D with translational grants and innovation incubators. As scientific capability rises and venture capital deepens, Asia Pacific’s early drug development ecosystem is poised to deliver not just services, but innovation paving the way for an Asia-driven pharmaceutical future.

Asia Pacific Drug Development Market By Mode Insights

Outsourced drug development services dominate the Asia Pacific market, with multinational pharmaceutical companies increasingly relying on Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs) in the region. Outsourcing is attractive due to scalability, cost containment, access to diverse patient populations, and specialized local expertise. Global CROs like IQVIA and Parexel have extensive operations in countries like India and China, offering services from clinical trial management to regulatory submissions. Meanwhile, homegrown players like WuXi AppTec (China), Syngene (India), and LSK Global Pharma Services (South Korea) are gaining global prominence for their technical depth and regulatory compliance.

In-house drug development, while smaller in scale, is growing fast particularly among large domestic pharma firms and mature biotechs aiming to retain intellectual property and control over critical processes. Companies in Japan and South Korea are investing in their own R&D centers, formulating pipelines for oncology, cardiovascular, and metabolic disorders. For example, Takeda has expanded its in-house development capabilities through global acquisitions and integration of its Japanese R&D units. This dual-mode approach outsourcing for scale and in-house for innovation is defining the region’s drug development ecosystem.

Asia Pacific Drug Development Market By Process Steps Insights

Formulation development is the dominant step, especially in India and China, where cost-effective formulation services are provided for both novel and generic drugs. A large portion of global ANDAs (Abbreviated New Drug Applications) originate from Asia, driven by high-volume solid oral, injectable, and topical formulation capabilities. CDMOs across Asia also offer specialized services for nanoformulations, controlled-release tablets, and lipid-based carriers. With high-throughput formulation labs and scale-up expertise, this segment continues to anchor global pharma outsourcing to Asia Pacific.

DMPK (Drug Metabolism and Pharmacokinetics) is one of the fastest-growing segments, fueled by rising demand for predictive ADME/Tox profiling in early-stage drug development. Precision dosing, biomarker analysis, and exposure modeling are increasingly important in biologics and targeted therapies. South Korea and Japan, with strong academic collaborations and advanced lab infrastructures, are emerging as leaders in this space. DMPK services are being integrated into AI-powered discovery platforms and preclinical testing, offering real-time insights for faster go/no-go decisions.

Asia Pacific Drug Development Market By Therapeutic Area Insights

Oncology remains the leading therapeutic focus in drug development across Asia Pacific, reflecting the global rise in cancer incidence and the growing availability of biomarkers and molecular targets. China’s NMPA, for example, has prioritized oncology drugs under its accelerated approval pathway, resulting in a surge of cancer trials and partnerships. Biopharma companies are increasingly leveraging Asian populations for early-phase trials due to genetic heterogeneity, treatment-naïve patients, and supportive regulatory frameworks. Targeted therapies, immuno-oncology agents, and antibody-drug conjugates (ADCs) are the most active subfields.

Inflammation and immunology is the fastest-growing therapeutic area, particularly in Japan and Australia, where autoimmune diseases, allergies, and rare inflammatory disorders are becoming more prevalent. Biologics and biosimilars targeting TNF-α, IL-17, and JAK pathways are being developed or trialed by regional biotechs and multinationals. Clinical and translational research centers are actively pursuing immunology pipelines, and several regional CROs have built therapeutic-specific expertise in protocol design and patient stratification. This area is expected to see exponential growth with the rise of precision immunotherapies and companion diagnostics.

Asia Pacific Drug Development Market By Regional Insights

China leads the Asia Pacific drug development market by scale, growth, and regulatory reform momentum. The country has rapidly transitioned from a manufacturing-centric pharmaceutical model to an innovation-driven ecosystem. The National Medical Products Administration (NMPA) has streamlined its clinical trial application system and introduced fast-track approvals for priority diseases. As a result, both domestic and global companies are conducting early- and late-phase trials in China, particularly for oncology, rare diseases, and monoclonal antibody therapies.

Key players like WuXi AppTec, BeiGene, and I-Mab Biopharma are not only serving global sponsors but also advancing proprietary molecules. The government-backed “Made in China 2025” policy and the Healthy China 2030 blueprint emphasize self-reliance in drug innovation, offering incentives and funding to developers. Additionally, the expansion of clinical trial networks, digital health infrastructure, and regional talent hubs like Shanghai and Beijing position China as the anchor market for drug development in Asia Pacific.

Some of the prominent players in the Asia Pacific drug development market include:

Asia Pacific Drug Development Market Recent Developments

-

In March 2025, WuXi AppTec announced the launch of a new integrated drug discovery and development center in Shanghai to support U.S. and European clients with end-to-end services.

-

Parexel partnered with South Korea’s CHA University in April 2025 to establish a translational research and clinical operations hub focused on immuno-oncology.

-

Syngene International, based in India, opened a 100,000-square-foot bioanalytical lab in January 2025 to expand support for biologics development.

-

Takeda Pharmaceutical in February 2025 signed a collaboration with Singapore’s A*STAR to co-develop early-phase oncology assets with potential for global trials.

-

In May 2025, Novotech, a leading Asia-Pacific biotech CRO, announced the acquisition of a regulatory services firm in Thailand to strengthen its regional footprint.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Asia Pacific drug development market

By Mode

By Process Step

- Process Research Development

- Formulation

- Analytical & Stability Studies

- DMPK

- Safety Assessment (Toxicology)

- Regulatory Compliance

- Packaging

By Therapeutic Area

- Oncology

- Inflammation & Immunology

- Cardiology

- Neuroscience

- Others

By Regional

-

- China

- Japan

- India

- Australia

- South Korea

- Thailand